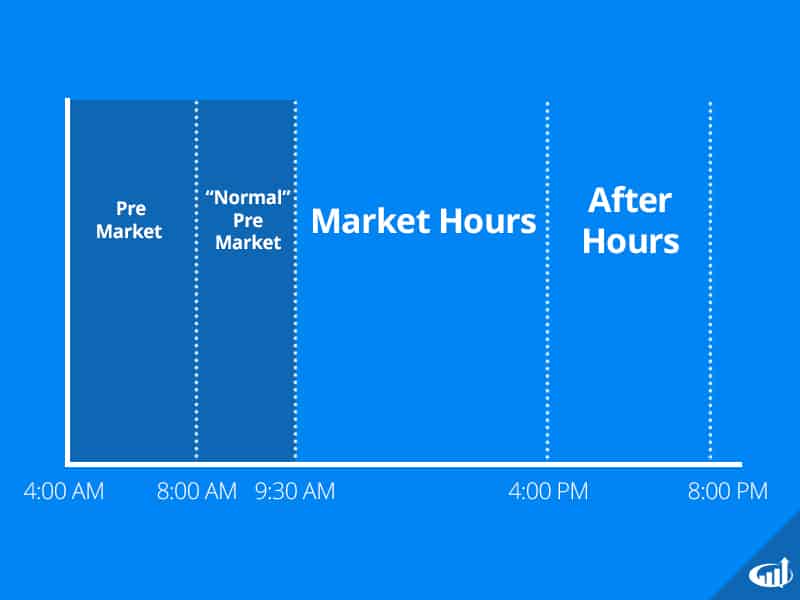

There are some things you’ll want to keep in mind about after-hours trading. In most cases, after-hours trading in the U.S occurs during the hours of 4–8 p.m., at which time buy and sell orders can be placed and executed.

The hours to buy and sell stocks after hours can be different, depending on the type of ECN platform a trader uses. How long is after-hours trading? The answer is not as simple. When trading during either pre-market or after hours, trading is done entirely through ECNs. ECNs are computer-based matching systems that pair buy and sell orders in the market, allowing trades to be completed electronically, without the need for any physical presence (aka off-the-floor trading). However, technology has leveled the playing field, allowing individual and retail investors to engage in pre-market and after-hours trading as well.ĭuring the exchanges’ regular hours, investors can buy and sell shares of stock on the NYSE, NASDAQ, and other global exchanges, as well as electronic communication networks (ECNs).

#PREMARKET TRADING PROFESSIONAL#

There was a time when after-hours trading was only for the investing elite, consisting of professional and high profile investors. All after-hours trading is completed digitally through electronic communication networks (ECNs).Īs you might expect, after-hours trading occurs when the normal hours of the stock exchange end and the market closes for the day.As with any type of investing, there are both advantages and disadvantages of after-hours trading.After-hours trading occurs when the normal hours of the stock exchange end and the market closes for the day.To get a better understanding of what after-hours trading is, how it works, and why you may want to (or not!) trade during this time, read on to learn everything you need to know. Since then, the New York Stock Exchange (NYSE) introduced extended hours in the way of pre-market and after-hours trading.

But that all changed in 1991 in acknowledgment of international exchanges’ longer trading hours and the increased competition they presented. Throughout the stock exchange’s history, it operated Monday–Friday, from 9:30 a.m.

#PREMARKET TRADING HOW TO#

0 kommentar(er)

0 kommentar(er)